Constructing wealth is a standard aspiration many individuals share, but it’s a journey that usually entails appreciable effort and time. The trail to monetary success is not marked by mere luck or spontaneous windfalls. As a substitute, it’s a calculated trek requiring strategic planning and a steadfast dedication to 1’s monetary targets. On the coronary heart of this endeavor, two essential virtues—self-discipline and endurance—play pivotal roles in shaping how wealth is accrued and sustained over time. These attributes work in tandem to make sure that the dream of economic independence can certainly turn out to be a actuality.

Understanding the ideas of wealth constructing is crucial for anybody trying to safe a affluent future. Monetary specialists typically stress the significance of cultivating disciplined habits and adopting a affected person mindset when navigating the complexities of funding and financial savings. These core ideas not solely guard in opposition to impulsive and sometimes detrimental choices but additionally present the regular basis wanted for long-term monetary well being. Whether or not you are a newbie investor or somebody attempting to scale up your investments, self-discipline and endurance are irreplaceable pillars in your monetary technique.

Within the fast-paced world we dwell in, it’s simple to succumb to the attract of fast earnings and rapid gratification. A myriad of funding schemes promise astronomical returns in document time, drawing in fanatics who search speedy wealth with no full appreciation for the dangers concerned. Nonetheless, real wealth creation focuses on methods which can be sustainable over the long run—an ethos the place self-discipline and endurance naturally shine. Adhering to this philosophy minimizes potential losses and nurtures the expansion of a sound monetary portfolio.

This text will delve into the intricacies of wealth constructing by analyzing the essential roles of self-discipline and endurance. We’ll discover varied aspects of economic planning, funding methods, long-term objective setting, and the impression of impulsive choices on monetary well being. Alongside, we are going to showcase real-world success tales that spotlight how self-discipline and endurance have paved the way in which for sustainable wealth creation. By understanding and implementing these very important components, you possibly can set your self on a path towards monetary freedom and safety.

Introduction to Wealth Constructing

Wealth constructing is a course of that entails accumulating assets and property over time. It is a strategic endeavor that requires cautious planning and a stable understanding of economic ideas. The essence of wealth constructing is to create a monetary cushion that may not solely assist one’s life-style but additionally generate revenue to maintain future endeavors.

To embark on this journey, it is essential to develop a mindset that’s oriented in the direction of each development and safety. Wealth constructing shouldn’t be merely about amassing riches; it’s about creating worth and guaranteeing that your funds are resilient sufficient to climate financial storms. This implies taking a complete strategy that features saving, investing, and managing debt correctly.

One of many elementary approaches to wealth constructing is to set clear and practical monetary targets. These targets must be each short-term and long-term and canopy varied features of your monetary life, reminiscent of retirement financial savings, funding schooling, and constructing emergency funds. By setting a roadmap, you lay down the parameters inside which you’ll measure progress and make knowledgeable choices.

The Function of Self-discipline in Monetary Planning

Self-discipline is the foundational bedrock upon which profitable monetary planning is constructed. Within the context of wealth constructing, self-discipline is mirrored within the potential to stick to a monetary plan and resist the temptations that might derail your progress. Whether or not it is sticking to a price range or sustaining a rigorous financial savings routine, self-discipline ensures that your monetary goals stay inside attain.

A disciplined monetary planner prioritizes bills, setting apart needs for wants and allocating assets the place they’re best. This requires a level of frugality and the willingness to make sacrifices for future advantages. Self-discipline additionally entails the common monitoring and adjustment of economic methods to adapt to altering circumstances with out deviating from the overarching targets.

Furthermore, self-discipline in monetary planning encapsulates the regularity of contributing to financial savings and funding accounts. Even when it appears difficult, a disciplined strategy ensures that financial savings and investments are constant. This consistency is essential, significantly as a result of the ability of compound curiosity depends closely on common contributions over time.

Understanding the Significance of Persistence in Investments

Persistence is a advantage in life, and it holds significantly true within the realm of investments. The funding panorama is usually fraught with volatility, the place markets can rise and fall dramatically inside brief spans. Throughout these fluctuations, endurance turns into an investor’s best ally, permitting them to remain the course amidst market chaos.

Buyers who grasp the significance of endurance perceive that important wealth accumulation doesn’t occur in a single day. It’s somewhat the results of regular, long-term development that compounds over years and a long time. By resisting the urge to make hasty choices primarily based on short-term market actions, affected person buyers usually tend to obtain their desired monetary outcomes.

Moreover, endurance permits buyers to trip out intervals of poor efficiency and downturns, trusting of their analysis and established monetary plans. Historic knowledge has proven that markets usually pattern upwards over lengthy intervals. This understanding underscores the significance of a long-term perspective, the place endurance fosters resilience and an unwavering dedication to monetary targets.

Time Horizons and Lengthy-term Monetary Objectives

Understanding your time horizon is paramount in monetary planning, because it considerably influences your funding choices and threat tolerance. A time horizon refers back to the anticipated period over which your monetary targets have to be achieved. Sometimes, longer time horizons enable for extra aggressive funding methods given their better capability to soak up market fluctuations.

Lengthy-term monetary targets, reminiscent of retirement planning or wealth succession, necessitate a complete and forward-looking strategy. Key to reaching these targets is growing a portfolio that balances threat with anticipated returns. As an illustration, youthful people may prioritize development investments like shares, given their longer time frames, whereas older buyers may shift in the direction of secure, income-generating property.

The idea of matching your investments together with your monetary timetable is a strategic option to align assets with anticipated monetary wants. This alignment aids in buffering in opposition to market volatility and ensures that assets can be found when required. An in depth understanding of your monetary timeline, due to this fact, empowers extra knowledgeable funding choices and rational threat assessments.

Budgeting: A Key Part of Self-discipline

Budgeting stands as a cornerstone of economic self-discipline, appearing as a strong software that may drive wealth creation. Via budgeting, people achieve a transparent image of their revenue and expenditures, enabling them to allocate assets optimally and keep away from the pitfalls of overspending or accumulating debt.

A well-maintained price range facilitates the setting and prioritizing of economic targets. By defining particular targets and the time-frame for reaching them, budgeting offers a roadmap that retains monetary aspirations practical and achievable. Moreover, by together with saving and funding allocations in a price range, people can repeatedly contribute to future wealth.

Furthermore, budgeting teaches the excellence between discretionary and crucial expenditures. This readability encourages extra conscious spending behaviors, lowering the monetary pressure brought on by impulse procuring or life-style inflation. Common evaluations and changes to the price range can even assist tackle altering monetary circumstances, underscoring the need of flexibility whereas sustaining general self-discipline.

The Impression of Impulsive Selections on Wealth

Fast, unconsidered monetary choices can considerably undermine wealth-building efforts. Impulsivity typically leads people to make purchases or funding decisions that aren’t aligned with their long-term monetary targets, finally derailing deliberate financial savings or funding methods.

Frequent impulsive choices embody overspending throughout gross sales, making investments primarily based on market hype, or withdrawing funds prematurely from long-term investments. Every of those actions can have cascading results that disrupt monetary plans. The important thing to safeguarding wealth is to domesticate a behavior of knowledgeable decision-making, grounded in prudence and long-term considering.

To counteract impulsivity, it’s vital to implement mechanisms reminiscent of cooling-off intervals earlier than main purchases and looking for skilled recommendation earlier than coming into unfamiliar funding markets. Moreover, linking monetary choices to long-term targets may also help reinforce endurance and self-discipline, lowering the probability of missteps that might jeopardize monetary success.

How Persistence Contributes to Funding Progress

Persistence is an indispensable aspect within the development of investments, offering the essential time wanted for property to understand. The character of most development investments, reminiscent of shares and actual property, is that they require time to yield returns. Recognizing this temporal side is critical for capitalizing on the total potential of those asset lessons.

One of many tangible methods endurance manifests in funding development is thru the ability of compounding. Compounding ensures that the returns earned on an funding are reinvested to generate further returns, making a snowball impact over time. This phenomenon thrives in affected person funding methods, the place buyers let their cash work over prolonged intervals.

Furthermore, affected person buyers have the benefit of coming into markets when others exit attributable to panic, typically securing property at decrease costs. Generally known as contrarian investing, this technique rewards those that can foresee the long-term horizon and have the endurance to behave in opposition to non permanent market sentiments. Constantly making use of endurance in funding practices can lead to a sturdy portfolio and sustained wealth accumulation.

Case Research: Profitable Wealth Builders Who Emphasised Self-discipline and Persistence

Analyzing the lives of profitable wealth builders provides useful insights into how self-discipline and endurance can drive monetary success. These people typically share frequent traits: a dedication to monetary schooling, disciplined spending habits, and a affected person funding strategy.

Warren Buffett

Probably the most famend buyers of all time, Warren Buffett exemplifies how endurance and self-discipline can result in extraordinary wealth creation. Generally known as the “Oracle of Omaha,” Buffett’s funding technique is centered round worth investing—shopping for shares which can be undervalued and holding onto them for the long run. His disciplined strategy to monetary administration and affected person holding of investments has allowed him to constantly develop his wealth.

Sarah Blakely

Founding father of Spanx, Sarah Blakely’s journey displays the ability of disciplined financial savings and entrepreneurial endurance. She began with simply $5,000 in financial savings and confronted quite a few rejections earlier than her breakthrough. Her dedication to funding her goals with out incurring debt and her willingness to take a position time in perfecting her product innovation paved the way in which to her success.

John D. Rockefeller

As certainly one of historical past’s wealthiest people, Rockefeller’s story underscores the significance of a disciplined strategy to price administration and strategic endurance in enterprise growth. His cautious eye on manufacturing efficiencies and market management exemplifies how taking note of element and having the endurance for long-term outcomes can create huge wealth.

These case research reveal that the trail to monetary success is usually much less about groundbreaking methods and extra about mundane—but highly effective—habits of self-discipline and endurance.

Setting Real looking Expectations for Monetary Progress

Establishing practical expectations is essential when setting monetary targets and planning for wealth creation. It is necessary to steadiness optimism with pragmatism, understanding each the potential and limitations of various funding automobiles and financial savings plans.

To formulate practical monetary expectations, people ought to account for components reminiscent of market volatility, financial cycles, and particular person threat tolerance. By doing so, they will develop a complete technique that’s each bold and achievable, establishing benchmarks that measure progress with out undue stress.

Setting attainable milestones inside a monetary plan helps preserve motivation and focus. This will contain pinpointing short-term achievements, reminiscent of paying off money owed, alongside long-term goals like making ready for retirement. By conserving expectations grounded in actuality, people are higher positioned to maintain their monetary course and obtain the specified development over time.

Methods for Sustaining Self-discipline Throughout Monetary Turbulence

Monetary turbulence is inevitable, however with the fitting methods, you possibly can preserve self-discipline and guarantee your wealth-building efforts proceed unimpeded. Step one in navigating monetary instability is to have a proactive and well-maintained contingency plan.

Emergency Fund

Having an emergency fund that covers a number of months’ price of bills is essential. This reserve acts as a buffer, permitting people to satisfy surprising prices with out derailing their monetary technique or incurring debt.

Constant Assessment

Often reviewing and adjusting monetary plans in response to financial indicators helps pinpoint areas the place changes could also be crucial. This disciplined strategy mandates staying knowledgeable and making calculated, somewhat than reactionary, monetary choices.

Diversification

To mitigate threat, diversification is vital. This entails spreading property throughout varied funding lessons and sectors to cut back publicity to any single market fluctuation. A well-diversified portfolio can supply stability and assist the upkeep of self-discipline throughout difficult instances.

By using these methods, people can uphold a disciplined strategy to wealth creation, even amidst monetary turbulence, guaranteeing continued progress towards their monetary targets.

Conclusion: The Synergy of Self-discipline and Persistence in Wealth Creation

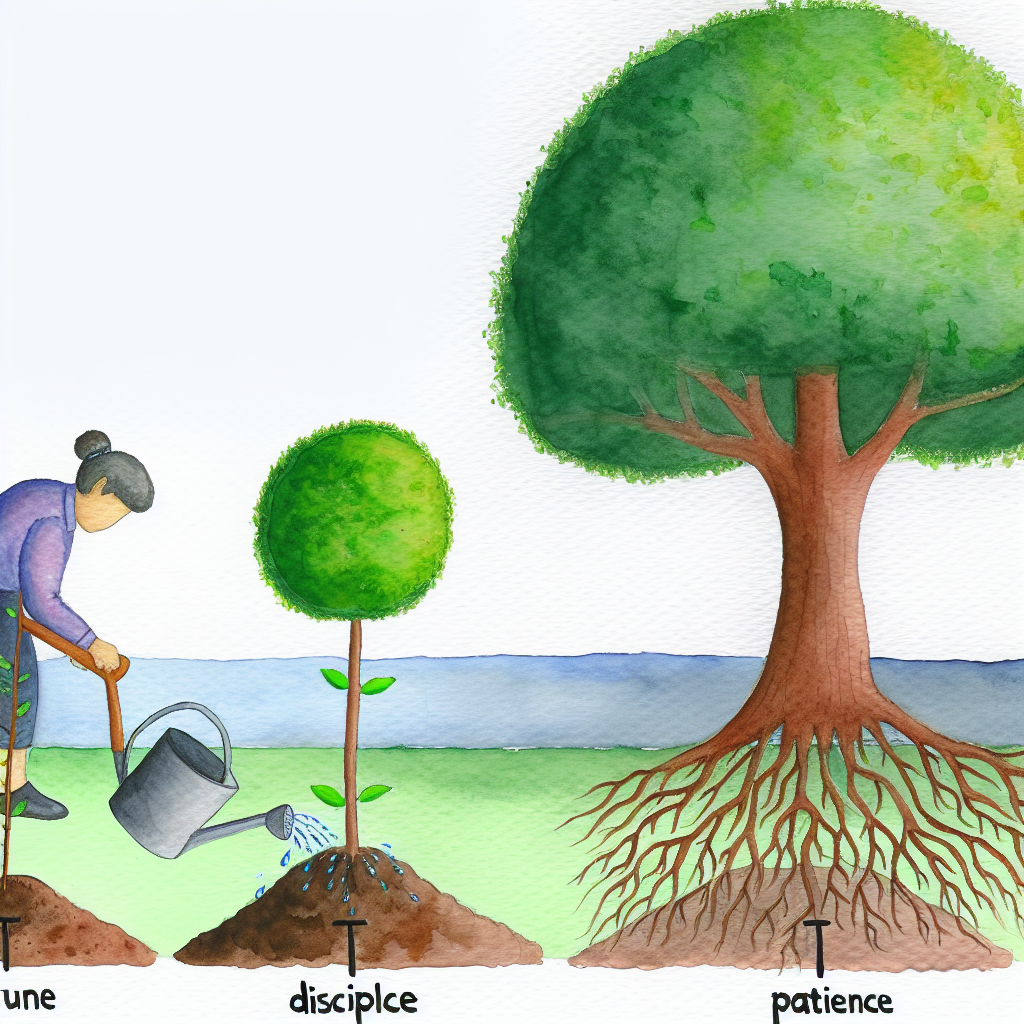

In conclusion, the journey of constructing wealth is neither speedy nor easy. It requires a devoted dedication to the values of self-discipline and endurance, virtues that collectively construct a resilient monetary basis. Self-discipline equips you with the construction crucial for sound decision-making, permitting for constant saving and funding habits. It curtails the urges that result in poor monetary decisions, sustaining a gentle trajectory towards your targets.

Persistence enhances self-discipline by fostering a mindset that’s resilient to the short-term volatility of economic markets. It encourages a give attention to long-term good points over fleeting successes and assures buyers of the eventual rewards ready on the horizon. Collectively, self-discipline and endurance kind a synergy that strengthens every side of economic planning and wealth accumulation.

For these trying to embark on a wealth-building journey, cultivating these virtues must be a precedence. As illustrated all through this text, the power to stay disciplined and affected person amidst uncertainty not solely secures monetary stability but additionally paves the way in which for a wealthy and rewarding future. These enduring ideas will at all times stay related, guiding particular person wealth-builders of their quest for lasting monetary success.

FAQ

What’s the significance of self-discipline in wealth constructing?

Self-discipline is significant in wealth constructing because it enforces constant saving and investing behaviors, serving to people adhere to monetary plans and keep away from impulsive spending that might derail their monetary targets.

How does endurance impression funding success?

Persistence impacts funding success by permitting property the required time to develop and compound, thereby enhancing potential returns and mitigating the consequences of market volatility.

Why is budgeting necessary for monetary success?

Budgeting is prime because it offers a transparent roadmap for managing revenue and bills, guaranteeing that assets are allotted effectively and monetary targets are pursued methodically.

What are some methods to develop endurance in investing?

To develop endurance in investing, people can give attention to long-term targets, diversify their funding portfolio to cut back threat, and keep away from making choices primarily based on short-term market fluctuations.

How can one preserve self-discipline throughout financial uncertainty?

Sustaining self-discipline throughout financial uncertainty will be achieved by organising an emergency fund, repeatedly reviewing monetary plans, and diversifying investments to mitigate threat.

Recap

- Constructing wealth calls for each self-discipline and endurance for strategic monetary development.

- Self-discipline in finance ensures constant financial savings and funding habits.

- Persistence permits investments the time wanted to develop and compound.

- Setting practical monetary targets and expectations is crucial for sustained success.

- Budgeting, disciplined planning, and affected person investing foster sound wealth creation methods.

- Profitable wealth builders exemplify the effectiveness of those virtues by their disciplined and affected person approaches.

- Methods to deal with financial turbulence embody sustaining emergency funds and diversified portfolios.

References

- Buffett, M., & Clark, D. (2011). Warren Buffett and the Interpretation of Monetary Statements. Scribner.

- Blakely, S. (2019). The Spanx Story: What Makes Sarah Blakely an Enterprise Lady. Success Publishers.

- Rockefeller, J. D. (1909). Random Reminiscences of Males and Occasions. Doubleday.