The Significance of Diversification in Funding Portfolios for Threat Administration

Within the huge world of funding, a well-crafted technique is crucial for fulfillment, notably when aiming for each progress and safety. One of many basic rules employed by buyers worldwide is diversification. Diversification includes spreading investments throughout varied monetary devices, industries, and different classes to scale back publicity to any single asset or danger. This strategy is just not a novel thought, however its significance can by no means be overstated.

The core premise of diversification in investments is danger administration. No funding is with out danger, and each investor goals to maximise returns whereas minimizing potential losses. By diversifying, buyers can shield their portfolios from main downturns in particular markets or sectors. The precept is usually likened to the proverb of not placing all one’s eggs in a single basket, emphasizing the discount of danger by means of spreading investments.

The importance of funding portfolio diversification extends past mere danger mitigation. It permits buyers to faucet into totally different progress alternatives, doubtlessly main to higher total portfolio efficiency. In at present’s interconnected world financial system, an investor with a diversified portfolio can profit from progress tendencies in varied areas and sectors.

Nevertheless, attaining balanced diversification is not nearly shopping for totally different shares or monetary merchandise indiscriminately. It requires strategic planning, understanding of market dynamics, and identification of varied components that may affect market situations. As we delve deeper into this matter, the advantages and complexities surrounding diversification will unfold, offering insights into why it stays a cornerstone for any prudent investor’s technique.

Introduction to Funding Diversification: What it Is and Why it Issues

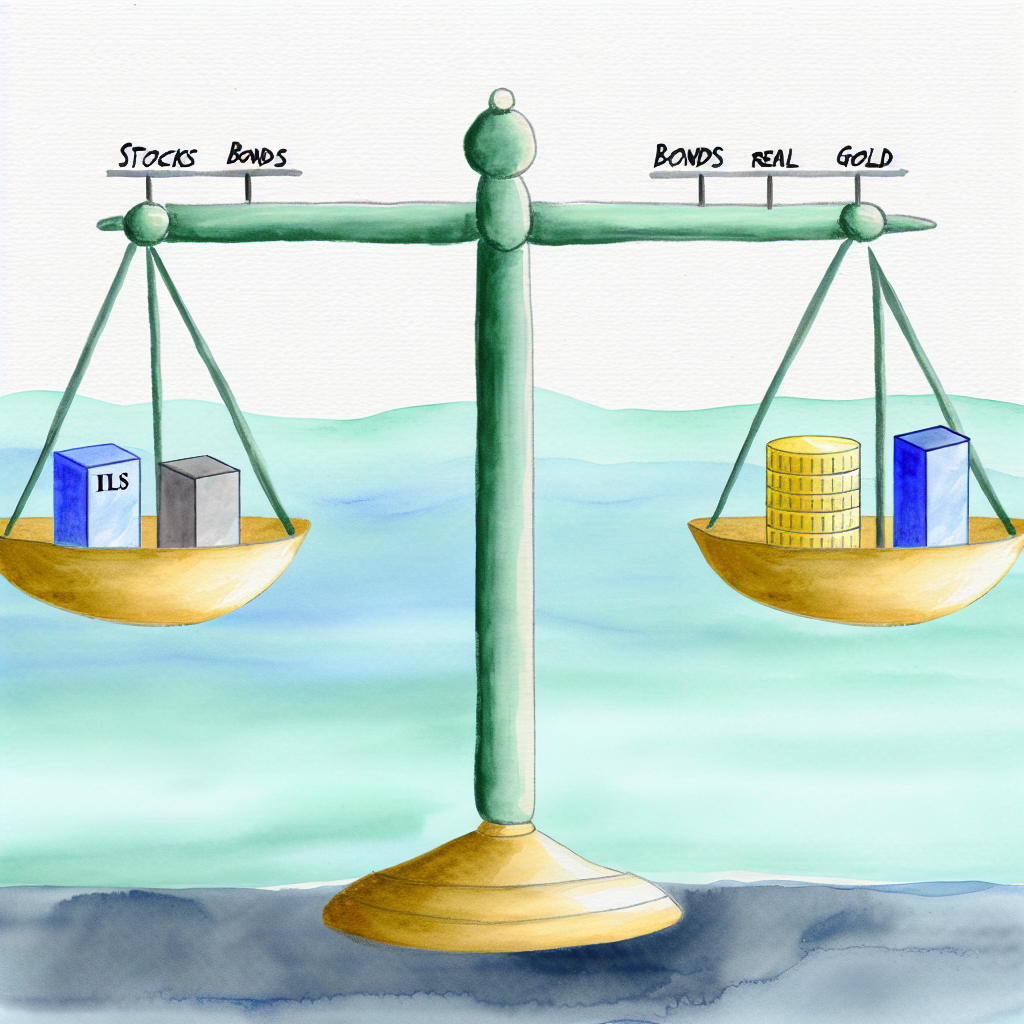

Funding diversification is a strategic strategy to decreasing danger in a portfolio. By investing in a mixture of belongings, reminiscent of shares, bonds, actual property, or commodities, an investor can defend themselves from important losses ought to one asset underperform. The first intention is to realize a fascinating steadiness between danger and return.

Why does diversification matter? The reply lies within the unpredictability of markets. Completely different asset courses reply otherwise to market cycles, financial developments, or geopolitical occasions. As an illustration, whereas inventory markets would possibly carry out poorly in occasions of financial uncertainty, bonds or commodities like gold would possibly maintain their worth and even respect. Diversification ensures {that a} portion of your funding can nonetheless prosper, offsetting potential losses from different components of your portfolio.

Furthermore, diversification enhances capital appreciation potential. By spreading investments, one can seize progress in varied sectors that will not be correlated with one another. This balanced strategy can ease the anxiousness of buyers, understanding that whereas one section of their funding would possibly falter, others may nonetheless thrive.

Understanding Threat and Return in Investing

The connection between danger and return is a basic idea in investing. The final rule is that with greater potential returns comes greater danger. Understanding this dynamic is essential for any investor when devising their funding technique. Threat is inherent in all investing choices, however the kind and stage of danger can differ.

Returns, then again, check with the beneficial properties or losses made out of investments. Relying on the chance related, these returns can differ considerably. Increased returns are normally focused to compensate for greater danger ranges. For instance, shares are thought of high-risk in comparison with authorities bonds, however in addition they provide greater potential returns over time.

Efficient funding portfolio diversification performs a job in managing these dangers. By fastidiously choosing a mixture of investments that complement one another by way of danger and return, buyers can obtain a extra steady funding expertise. The problem is in balancing these parts to suit particular person funding objectives and danger tolerances.

The Position of Diversification in Decreasing Threat

Diversification is primarily about danger discount. By spreading investments throughout varied asset courses, industries, and geographical areas, buyers can defend their portfolios from market volatility. Diversification doesn’t assure earnings, nor does it guarantee towards losses, however it’s an efficient device in decreasing danger.

Completely different asset courses have various ranges of danger and potential reward. As an illustration, whereas shares are sometimes unstable, with potential for substantial returns, bonds are typically extra steady with decrease returns. By together with a mixture of each in a portfolio, an investor can offset potential inventory market losses with bond revenue.

Along with asset courses, geographical diversification is vital. Financial or political instability in a single area may need extreme results on that native market, however by investing globally, an investor can mitigate these dangers. This geographical unfold can result in extra constant returns as markets in several areas don’t at all times transfer in tandem.

Completely different Kinds of Diversification: Asset Lessons

Diversifying inside asset courses means holding a spread of belongings in several classes to attenuate danger. This diversification will be damaged down into a number of classes:

- Shares: Investing in several sectors reminiscent of know-how, healthcare, or vitality.

- Bonds: Spreading investments throughout authorities bonds, company bonds, or municipal bonds.

- Actual Property: Diversifying between residential, business, or industrial properties.

- Commodities: Investing in gold, silver, oil, or agricultural merchandise.

Every of those asset courses responds otherwise to market situations. As an illustration, commodities would possibly carry out effectively when inflation is excessive, whereas shares may battle. By spreading investments throughout these numerous classes, a portfolio’s efficiency turns into much less depending on any single asset’s efficiency.

| Asset Class | Description | Threat Degree |

|---|---|---|

| Shares | Possession in an organization | Excessive |

| Bonds | Loans to firms/authorities entities | Low to Medium |

| Actual Property | Funding in property | Medium |

| Commodities | Bodily items like gold, oil | Excessive |

Geography

Geographical diversification is vital, particularly in at present’s world financial system. Traders can profit from investing in worldwide markets, which may provide alternatives not out there domestically. Completely different geographical areas have distinctive financial cycles, rules, and market tendencies.

Financial situations can differ tremendously between international locations or areas. For instance, rising markets would possibly current greater progress potential in comparison with developed economies. Nevertheless, in addition they include greater dangers. Creating a geographically numerous portfolio helps to hedge towards dangers particular to any single location.

A geographically diversified portfolio sometimes consists of a mixture of investments from North America, Europe, Asia, and rising markets. This combine ensures that an investor is just not overly uncovered to dangers in anyone area and might profit from world progress tendencies.

Sectors

Sector diversification includes investing throughout totally different trade sectors. Every sector has distinctive traits and will be affected otherwise by financial shifts. Frequent sectors for diversification embrace know-how, healthcare, financials, and client items.

For instance, the know-how sector would possibly soar because of innovation and progress, whereas the vitality sector may face challenges from fluctuating oil costs or regulatory adjustments. By holding investments throughout a number of sectors, buyers can easy out returns and cut back the influence of sector-specific downturns.

Sector diversification ensures that an funding portfolio is just not put in danger by a downturn in anyone trade. It permits buyers to seize progress from totally different components of the financial system whereas sustaining a balanced strategy to danger.

Historic Case Research Illustrating the Advantages of Diversification

Historical past provides many classes demonstrating the advantages of diversification. One traditional instance is the Dot-com bubble burst within the late Nineties and early 2000s. Traders with concentrated positions in know-how shares skilled huge losses, whereas these with diversified portfolios have been in a position to mitigate losses and get better extra swiftly.

In the course of the 2008 monetary disaster, a diversified strategy additionally proved helpful. Whereas the inventory market plummeted worldwide, buyers with allocations in bonds, commodities, and different belongings have been in a position to cushion their portfolios towards extreme losses. Diversification throughout asset courses offered stability when fairness markets have been in turmoil.

One other instance is the regular progress seen by buyers who diversified into rising markets early. Whereas U.S. markets have been recovering from the monetary disaster, international locations like China and India have been experiencing strong progress, providing diversified buyers alternatives to reinforce returns.

Frequent Diversification Methods for Particular person Traders

Particular person buyers have a number of methods at their disposal to realize diversification. The best approach is thru mutual funds or exchange-traded funds (ETFs), which provide built-in diversification by holding a basket of various securities.

One other technique is the core-satellite strategy, the place the vast majority of the portfolio consists of low-cost diversified index funds or ETFs (core), with a smaller portion allotted to particular person shares or sectors (satellites). This strategy permits buyers to profit from market-wide beneficial properties whereas taking strategic positions in areas with perceived alternatives.

Actual property funding and investing in various belongings like commodities or hedge funds are additionally widespread methods. These not solely diversify however also can add totally different dimensions of danger and return to a portfolio.

The Dangers of Over-Diversification: Discovering the Proper Stability

Whereas diversification is useful, over-diversification can dilute potential returns and complicate a portfolio’s administration. Over-diversification happens when an investor holds too many belongings or securities, spreading dangers so thinly that the portfolio sacrifices potential beneficial properties.

Having too many belongings can result in expensive administration and extra transaction charges, outweighing potential advantages. It turns into difficult to observe and analyze all holdings successfully, resulting in inefficiencies.

To seek out the suitable steadiness, buyers ought to intention for a diversified portfolio that avoids extreme overlap between investments whereas sustaining sufficient breadth to guard towards downturns in anyone space. Many monetary advisors advocate aiming for a portfolio that features 20 to 30 totally different investments to realize sufficient diversification with out overextending.

The Impression of Diversification on Funding Efficiency

Diversification typically results in smoother funding efficiency. By hedging towards the volatility of particular person investments, it reduces the severity of losses and will increase the probability of regular returns. Nevertheless, diversification may additionally imply that in market upswings, a diversified portfolio might not seize all potential beneficial properties in comparison with a concentrated portfolio.

Over the long run, diversified funding portfolios usually exhibit much less volatility, resulting in compounding advantages. This constant efficiency is essential for buyers aiming for steady progress, reminiscent of these planning for retirement.

Funding portfolio diversification additionally permits buyers to stay invested by means of varied market situations confidently. By having publicity to totally different belongings, buyers are much less more likely to make emotionally pushed choices, reminiscent of promoting in a panic throughout downturns.

Diversification in Completely different Market Circumstances: Bull vs. Bear Markets

Diversification methods might yield totally different results in bull and bear markets. Throughout bull markets, a diversified portfolio might underperform concentrated portfolios which are closely invested in quickly rising sectors. Nevertheless, the constant, long-term advantages of diversification turn into evident in bear markets, the place it may possibly considerably cushion towards losses.

In bear markets, diversification helps shield the investor’s capital. Whereas some sectors decline, others would possibly stay steady and even develop. As an illustration, throughout financial downturns, defensive sectors like utilities or client staples usually carry out higher than cyclicals.

The bottom line is having a well-diversified plan that performs effectively throughout totally different market cycles. Constant diversification ensures that an investor is just not compelled to exit markets throughout downturns and might take part in recoveries.

How you can Begin Diversifying Your Funding Portfolio At present

Beginning portfolio diversification is easy:

-

Assess Present Holdings: Consider your present belongings to determine areas of excessive focus.

-

Analysis and Select Asset Lessons: Determine which asset courses align together with your danger tolerance and objectives.

-

Make the most of Monetary Merchandise: Contemplate mutual funds, ETFs, and index funds to realize broad publicity simply.

-

Contemplate Geographical and Sector Diversification: Look into world markets and totally different sectors to leverage worldwide progress and totally different trade cycles.

-

Repeatedly Rebalance: Monitor your portfolio and rebalance frequently to keep up your required diversification stage as markets fluctuate.

Participating a monetary advisor may also be helpful to offer customized steering suited to particular person objectives and monetary circumstances.

Conclusion: The Lengthy-term Advantages of Sustaining a Diversified Portfolio

A diversified funding portfolio is an important technique for managing funding danger and optimizing returns. It gives a balancing act, decreasing publicity to any single asset whereas capturing progress in a number of areas. Over the long run, this strategy facilitates sustainable and regular returns.

Traders who preserve diversification can climate market volatility extra successfully, decreasing the emotional and monetary impacts of downturns. By taking part in varied asset courses, geographical areas, and sectors, they place themselves to profit from totally different financial environments.

Finally, diversification is just not a one-time occasion however an ongoing course of that requires common evaluation and adjustment to align with evolving market situations and private monetary objectives. By embracing this technique, buyers can construct a resilient portfolio designed to thrive in numerous market environments.

Recap

- Diversification in investments helps mitigate dangers by spreading publicity throughout varied asset courses, sectors, and areas.

- Understanding danger and return dynamics is essential to steadiness potential beneficial properties with acceptance of uncertainty.

- Diversification reduces danger and smooths total portfolio efficiency, notably throughout market downturns.

- A balanced strategy avoids the pitfalls of over-diversification, which may dilute returns.

FAQ

-

What’s diversification in investments?

Diversification in investments includes spreading investments throughout totally different monetary belongings, sectors, or geographical areas to scale back publicity to danger. -

Why is diversification essential in an funding portfolio?

It will be important as a result of it minimizes the chance of considerable losses by balancing publicity throughout totally different belongings, stopping reliance on any single supply of progress or revenue. -

How does diversification have an effect on funding returns?

Though it may possibly restrict short-term beneficial properties throughout bull markets, diversification typically results in extra steady and constant returns over the long run. -

Can diversification remove funding danger fully?

No, whereas it reduces danger, diversification can not remove it fully. All investments carry some extent of danger. -

What are widespread diversification methods?

Frequent methods embrace investing in mutual funds, ETFs, and holding a mixture of asset courses like shares, bonds, and actual property. -

What’s the danger of over-diversification?

It might result in diminished returns as too many holdings might dilute the influence of strong-performing investments and result in greater charges. -

Does diversification work in all market situations?

Diversification is especially efficient in decreasing dangers throughout market downturns, offering a security internet, though it might underperform in strongly bullish markets. -

How do I begin diversifying my portfolio?

Start by assessing your present holdings, selecting a mixture of asset courses, and contemplating mutual funds or ETFs for simple diversification.

References

- Malkiel, B. G. (1999). “A Random Stroll Down Wall Avenue.” W.W. Norton & Firm.

- Bernstein, P. L. (1998). “Towards the Gods: The Outstanding Story of Threat.” Wiley.

- Bodie, Z., Kane, A., & Marcus, A. J. (2014). “Investments.” McGraw-Hill Training.