Introduction to Fintech and Its Significance in Trendy Finance

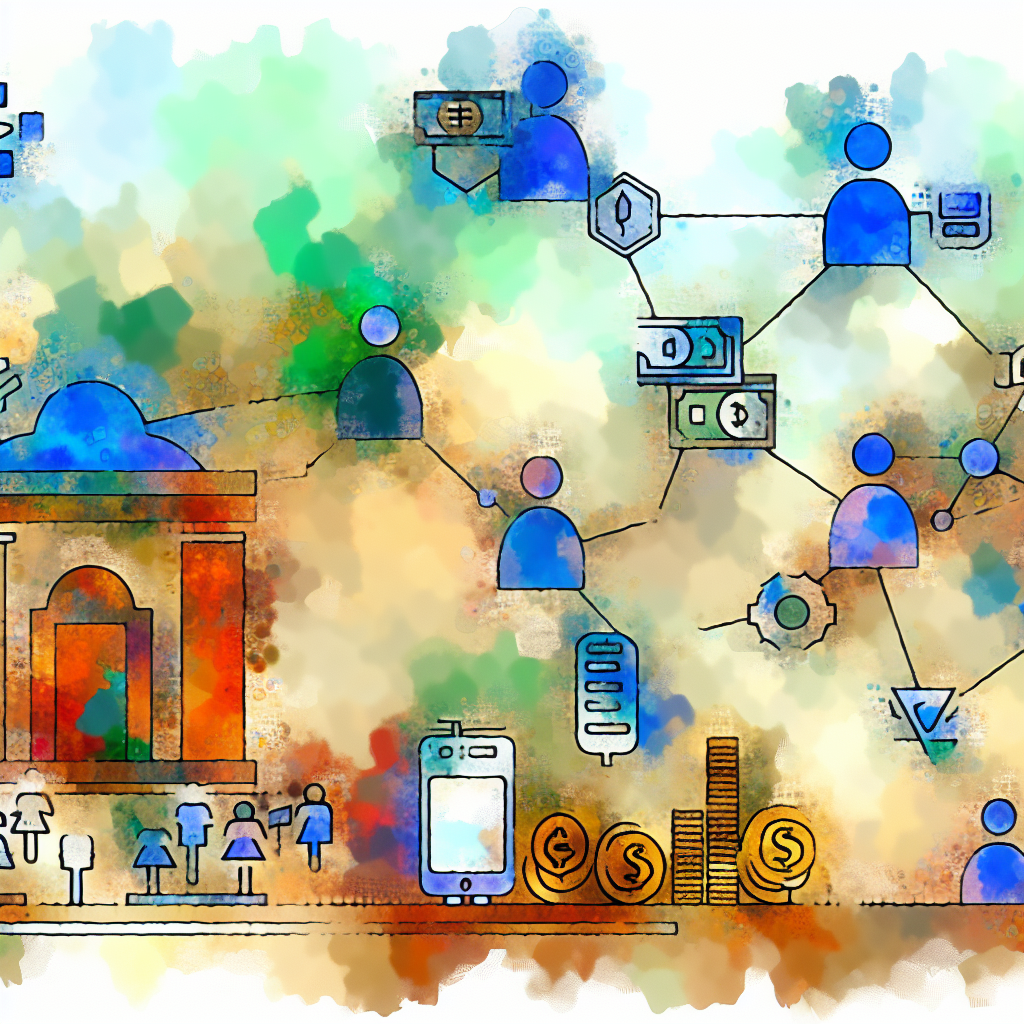

As the worldwide panorama of finance continues to evolve, fintech has emerged as a pivotal drive driving change and innovation inside the business. The time period “fintech” refers to any enterprise that makes use of expertise to reinforce or automate monetary companies and processes. From banking to insurance coverage, funding administration to fee methods, fintech is revolutionizing how monetary transactions are executed and perceived. Its fast developments are reshaping conventional monetary buildings, offering unprecedented entry and effectivity to companies and customers alike.

Fintech’s rise to prominence is essentially attributed to the rising demand for comfort and pace in monetary transactions. In an period the place digital transformations are rampant throughout industries, conventional banking establishments are discovering themselves compelled to adapt or face potential obsolescence. Shoppers in the present day demand sooner companies, extra streamlined experiences, and personalised choices tailor-made to their distinctive monetary conditions—calls for that fintech firms are well-equipped to satisfy.

One of many key features that underline the significance of fintech is its function in democratizing finance. Technological innovation has eliminated many boundaries to entry, permitting smaller gamers to disrupt a site beforehand dominated by giant establishments. This democratization has led to a extra aggressive market, leading to higher services and products for customers and decrease total prices.

Furthermore, the worldwide monetary panorama is turning into more and more interconnected. Fintechs not solely facilitate cross-border transactions and investments but additionally current important potential for monetary inclusion in underserved areas. By leveraging cell expertise and web connectivity, fintech firms can attain unbanked populations, providing them monetary companies that had been beforehand inaccessible.

Key Areas The place Fintechs Are Making an Influence

Fintech firms aren’t solely reworking conventional banking; they’re additionally redefining a number of key areas inside the monetary companies business. One distinguished space of influence is funds and cash transfers. By way of digital wallets and cell fee options, fintech firms simplify and expedite transactions, enabling customers to ship cash throughout the globe effectively and at a fraction of the price of conventional strategies.

One other crucial space is lending and credit score. Fintech companies have launched peer-to-peer lending platforms and streamlined credit score evaluation processes that rival these of typical banks. These improvements enable people and companies to entry funds rapidly, typically at aggressive rates of interest and with extra versatile phrases.

Funding administration can also be present process important adjustments as a consequence of fintech. The rise of robo-advisors, platforms that use algorithms to create and handle funding portfolios, affords a cheap various to conventional monetary advisors. These companies present personalised funding recommendation and portfolio administration to people who won’t have had entry to such choices earlier than.

Fintechs are additionally making strides within the insurance coverage sector, with the emergence of “insurtech” – technology-driven improvements aiming to reinforce the effectivity and supply of insurance coverage companies. By leveraging massive information and analytics, insurtech firms are in a position to provide personalized insurance coverage options, automate claims processing, and enhance buyer interplay and satisfaction.

How Fintechs Are Disrupting Conventional Banking

The appearance of fintech has not solely modernized monetary companies however has additionally offered important disruptions to conventional banking fashions. Probably the most substantial adjustments caused by fintech is the decentralization of economic companies. Historically, banks served because the central hub for monetary transactions, however fintechs are decentralizing this mannequin by providing centered companies via digital platforms that bypass the necessity for bodily branches.

Competitors is one other space the place fintechs are difficult banks. The nimbleness and innovation that fintech firms convey to the desk are unparalleled, typically providing options that banks can’t match as a consequence of their legacy methods and regulatory constraints. For instance, fintech startups are recognized for his or her agility in growing new merchandise, quickly testing them out there, and iterating primarily based on buyer suggestions.

Moreover, fintechs are disrupting the panorama by offering seamless integration with fashionable digital interfaces. With the rise of smartphones and the web, customers count on to handle their monetary actions with the identical ease they deal with social media or e-commerce. Fintech functions, with their intuitive consumer design and fast service supply, meet these expectations by providing options equivalent to instantaneous stability checks, real-time spending alerts, and simple cash transfers.

Lastly, the historically opaque nature of economic companies is being redefined by fintech’s dedication to transparency and customer-centric approaches. Many fintech firms are constructed on fashions that prioritize client schooling and monetary literacy, empowering customers to make knowledgeable selections concerning their monetary well being.

The Position of Fintechs in Enhancing Buyer Expertise

Buyer expertise has turn out to be a vital differentiator within the aggressive fintech panorama. A technique fintechs are enhancing buyer experiences is by prioritizing user-centric design. Digital platforms developed by fintech firms are designed with the client in thoughts, specializing in intuitive navigation, seamless entry to companies, and transparency of data.

One other enhancement in buyer expertise is thru personalization. By leveraging massive information and synthetic intelligence, fintechs can provide personalised monetary companies and recommendation, tailor-made to particular person client behaviors and preferences. This degree of customization in a monetary product was traditionally unavailable in conventional banking fashions.

Fintech firms have additionally succeeded in decreasing friction within the consumer expertise. The adoption of contactless funds, biometric authentication, and fast mortgage approvals ensures minimal inconvenience for customers. These applied sciences streamline processes that had been as soon as cumbersome, equivalent to identification verification, account set-up, and mortgage qualification, considerably bettering buyer satisfaction.

Furthermore, fintechs have embraced a consumer-friendly strategy when it comes to communication and assist. Many fintech functions now provide around-the-clock customer support via chatbots or reside assist, making certain that assistance is only a faucet away. This strategy not solely boosts buyer confidence but additionally fosters a way of reliability and belief within the fintech model.

Case Research: Profitable Fintech Corporations and Their Improvements

A number of fintech firms have made substantial impacts within the monetary companies world via distinctive improvements. Let’s look at just a few of those success tales and their contributions to fintech.

PayPal is likely one of the most well-known fintech firms, essentially altering the web fee house. By permitting customers to ship and obtain cash with out sharing monetary data, PayPal has constructed a safe platform that each prospects and companies belief. Its improvements embody adapting to cell commerce tendencies and increasing into digital wallets with companies like Venmo.

Stripe has revolutionized how companies settle for funds on-line. By creating easy, developer-friendly APIs, Stripe has empowered firms from startups to giant enterprises to combine on-line fee methods with ease. Stripe’s innovation lies in its capacity to deal with advanced fee processing seamlessly in a big selection of currencies and danger environments.

Robinhood has disrupted conventional brokerage industries by providing commission-free buying and selling via an easy-to-use app. By eliminating entry boundaries in investing, Robinhood has attracted a major consumer base, significantly amongst millennials and first-time buyers. Its real-time market information and simple interface present novice buyers with entry to an area that was as soon as intimidating and esoteric.

These case research exemplify how fintech firms leverage expertise to innovate and meet the evolving calls for of customers, thereby setting new requirements in monetary companies.

Regulatory Challenges and Alternatives for Fintechs

Whereas fintech firms proceed to drive innovation, they function below an more and more advanced regulatory atmosphere. One of many major challenges fintech companies face is compliance with an array of laws that adjust considerably throughout completely different areas. Navigating these laws requires substantial assets and experience, which may be significantly difficult for startups and smaller companies.

Nevertheless, this regulatory panorama additionally presents alternatives. As an example, the creation of regulatory sandboxes by some governments supplies fintech firms with an area to experiment and innovate with out going through fast regulatory restrictions. This setup encourages new developments whereas defending customers by making certain rigorous testing in a managed atmosphere.

Moreover, fintechs have the chance to form future regulatory environments by partaking in dialogue with regulators. Many authorities have acknowledged the potential of fintech to contribute positively to the monetary methods and are working with the business to develop frameworks that encourage innovation whereas safeguarding client pursuits.

The complexity of laws additionally drives fintech innovation in compliance-focused applied sciences, typically referred to as “regtech.” By way of regtech, fintechs are growing automated options to make sure compliance, handle danger, and improve information safety, resulting in a extra sturdy ecosystem the place fintechs can thrive alongside conventional monetary establishments.

Fintech and Monetary Inclusion: Reaching the Unbanked

Probably the most transformative impacts of fintech is its capacity to advertise monetary inclusion, significantly for unbanked and underbanked populations. By leveraging cell expertise and web connectivity, fintech firms are breaking down boundaries which have traditionally excluded people from accessing monetary companies.

A major space the place fintechs contribute to monetary inclusion is thru cell banking and digital fee methods. In lots of growing international locations, entry to conventional banking companies is restricted, however cell phone utilization is widespread. Fintech options present these populations with entry to monetary companies equivalent to financial savings accounts, loans, and insurance coverage with out the necessity for bodily financial institution branches.

Along with cell banking, fintechs additionally provide micro-loans and micro-insurance, that are tailor-made to low-income people who won’t meet the standards for typical monetary merchandise. By way of data-driven danger evaluation fashions, fintech firms can present these merchandise sustainably whereas sustaining affordability.

Moreover, fintech improvements in remittances have lowered prices and elevated effectivity for cross-border funds. Migrant employees worldwide depend on remittances to assist households of their dwelling international locations. Fintech companies like digital wallets and crypto-currencies expedite these transactions and scale back charges, making certain that extra funds attain the meant recipients.

The Way forward for Fintech: Tendencies to Watch

As we glance to the way forward for fintech, a number of key tendencies are poised to form the business. One among these tendencies is the rise of open banking, the place banks and fintechs collaborate by sharing information via APIs to offer extra complete companies. This pattern permits for a holistic strategy to monetary administration, the place customers can entry a number of monetary merchandise from completely different suppliers below one platform.

One other pattern is the rising use of synthetic intelligence and machine studying to enhance monetary evaluation, customer support, and fraud detection. These applied sciences will allow fintechs to supply much more personalised and predictive monetary companies, making certain a greater match for client wants and preferences.

Blockchain expertise continues to carry transformative potential for the fintech business. Past cryptocurrencies, blockchain’s safe, clear nature can revolutionize areas equivalent to fee processing, identification verification, and supply-chain finance, pushing fintech additional into the mainstream.

Sustainability in finance can also be turning into a substantial pattern, with inexperienced fintech rising as an essential space of focus. Fintech firms are starting to prioritize environmentally pleasant practices and merchandise, providing sustainable funding choices that cater to the rising variety of customers excited about environmental, social, and governance (ESG) standards.

How Monetary Establishments Can Collaborate with Fintechs

The continuing evolution of fintech begs the query of how conventional monetary establishments can coexist and thrive alongside these digital disruptors. Collaboration between banks and fintechs affords mutual advantages and is more and more being pursued as a method for modernization.

Monetary establishments can leverage fintechs’ technological prowess to reinforce their very own companies. By integrating fintech improvements, banks can enhance operational effectivity, scale back prices, and supply extra personalised buyer experiences. Partnerships can vary from joint ventures and acquisitions to strategic alliances and expertise licensing.

Collaboration additionally presents a possibility for banks to broaden their buyer base by adopting digital-first approaches championed by fintechs. This transformation may also help conventional banks enchantment to tech-savvy customers and youthful generations preferring digital engagement strategies.

Furthermore, collaborating with fintechs allows banks to foster a tradition of innovation. By embracing agile growth processes and technological advances from fintech counterparts, banks can speed up their very own modernization efforts and stay aggressive in a quickly altering monetary panorama.

Conclusion: The Ongoing Evolution of Monetary Companies via Fintech

In conclusion, the function of fintechs in reworking and modernizing monetary companies can’t be overstated. With their give attention to innovation, accessibility, and customer-centric options, fintech firms are progressively reshaping the panorama of economic companies.

The flexibility of fintechs to satisfy the evolving calls for of customers locations them in a novel place to problem conventional banking norms. By delivering sooner, extra handy, and sometimes extra inexpensive companies, fintechs are setting new benchmarks for monetary experiences.

Nevertheless, collaborative methods between conventional monetary establishments and fintechs provide the most effective path ahead. By embracing synergy slightly than competitors, each can contribute to a extra dynamic, inclusive, and resilient monetary ecosystem.

As fintechs proceed to advance and adapt, they may undoubtedly play a crucial function in driving the way forward for finance, making certain that expertise and monetary companies coalesce to satisfy the wants of all stakeholders.

Recap

- Fintechs are revolutionizing finance via expertise and innovation.

- Key impacts are seen in funds, lending, funding, and insurance coverage.

- Fintechs disrupt conventional banking with decentralization and transparency.

- They improve buyer experiences through user-centric design and personalization.

- Profitable fintech firms like PayPal, Stripe, and Robinhood exemplify innovation.

- Regulatory challenges exist, however alternatives for fintechs are rising.

- Monetary inclusion is promoted via cell banking and inexpensive options.

- Future tendencies embody open banking, AI, blockchain, and inexperienced fintech.

- Collaboration with fintechs advantages conventional monetary establishments.

FAQ

Q1: What’s fintech?

A1: Fintech refers to expertise and innovation geared toward bettering and automating the supply and use of economic companies.

Q2: How are fintechs completely different from conventional banks?

A2: Fintechs sometimes provide digital-first companies characterised by pace, accessibility, and user-centric experiences, whereas conventional banks typically depend on established processes and bodily branches.

Q3: What areas are most affected by fintech innovation?

A3: Funds, lending, funding, insurance coverage, and buyer expertise typically see essentially the most important impacts from fintech improvements.

This autumn: How do fintechs contribute to monetary inclusion?

A4: Fintechs present accessible monetary companies to unbanked populations via cell expertise, providing options like cell banking and microfinance.

Q5: What regulatory challenges do fintechs face?

A5: Fintechs should navigate various laws, typically requiring compliance with regional and worldwide legal guidelines, which may be resource-intensive.

Q6: Can conventional banks and fintechs collaborate efficiently?

A6: Sure, collaborations can result in mutual advantages, leveraging fintechs’ improvements to modernize banks’ companies and attain broader audiences.

Q7: What are some future tendencies in fintech?

A7: Future tendencies embody open banking, elevated use of AI and machine studying, blockchain functions, and a give attention to sustainability in finance.

Q8: How are buyer experiences improved by fintechs?

A8: Fintechs improve experiences via intuitive design, personalization, streamlined processes, and improved communication and assist.

References

-

Arner, D. W., Barberis, J., & Buckley, R. P. (2015). The evolution of fintech: A brand new post-crisis paradigm? College of Hong Kong School of Regulation Analysis Paper, 47.

-

Gomber, P., Koch, J. A., & Siering, M. (2017). Digital finance and fintech: Present analysis and future analysis instructions. Journal of Enterprise Economics, 87(5), 537-580.

-

Puschmann, T. (2017). Fintech. Enterprise & Info Techniques Engineering, 59(1), 69-76.