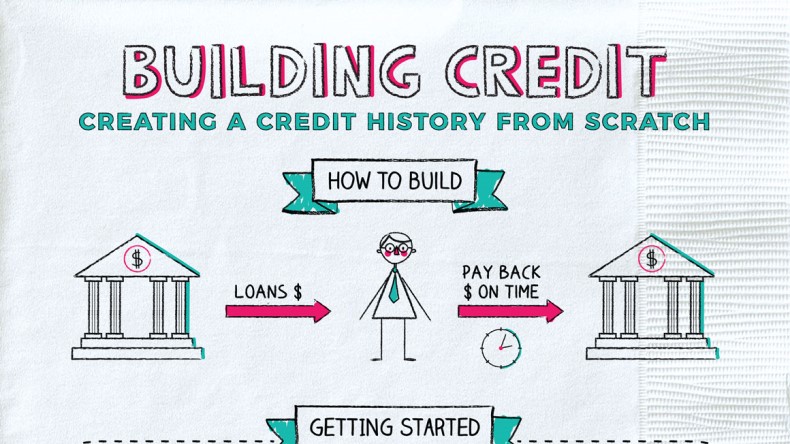

Building credit from scratch might seem like a daunting task, but it’s a crucial step in establishing a solid financial base. Having a good credit history opens doors to loans, credit cards, and better interest rates. Whether it’s to buy a home, a car, or even to secure approval for rentals, a good credit history serves as a financial passport for numerous opportunities.

Understanding Credit Basics

Credit, in its simplest form, is your financial reputation. It’s a reflection of how reliable you are in repaying borrowed money. Without any credit history, lenders and creditors might hesitate to extend credit due to the lack of evidence regarding your financial responsibility.

Getting Started: Secured Credit Cards and Starter Loans

One of the most effective ways to start building credit is by obtaining a secured credit card or a starter loan. Secured credit cards require a security deposit, usually equivalent to your credit limit, acting as collateral in case of default. These cards allow you to make purchases and establish a payment history, crucial for your credit profile.

Starter loans, often available at credit unions or community banks, are designed for those with little to no credit history. They are typically small installment loans that you repay over a fixed period, enabling you to demonstrate your ability to manage borrowed money responsibly.

Timely Payments and Responsible Credit Use

Once you have access to credit, the key to building a positive credit history lies in making timely payments. Payment history significantly influences your credit score, so aim to pay bills before or on their due dates. Even a single missed or late payment can have a negative impact on your credit profile.

It’s also crucial to use credit responsibly. Avoid maxing out your credit cards and try to keep your credit utilization ratio—the amount of credit used compared to the total available credit—below 30%. Responsible use demonstrates restraint and financial discipline, which are highly regarded by creditors.

Monitor and Review Your Credit Report Regularly

Regularly monitoring your credit report allows you to spot errors or inaccuracies that might negatively affect your creditworthiness. You’re entitled to a free credit report from each of the major credit bureaus—Equifax, Experian, and TransUnion—annually. Review these reports to ensure all information is accurate, and if any discrepancies arise, promptly dispute them with the respective bureau.

Identifying Errors and Inaccuracies

Credit reports can sometimes contain errors or inaccuracies that might impact your creditworthiness negatively. These errors could range from incorrect personal information to accounts erroneously reported as delinquent. By reviewing your credit report regularly, you can promptly identify and address these discrepancies.

Safeguarding Against Identity Theft and Fraud

Monitoring your credit report acts as a safeguard against identity theft and fraud. Unauthorized accounts or suspicious activities can appear on your report, indicating potential identity theft. Early detection allows you to take swift action, such as placing a fraud alert or freezing your credit, to prevent further damage.

Understanding Your Financial Standing

Your credit report provides a comprehensive snapshot of your financial behavior. It includes information about your credit accounts, payment history, inquiries, and public records like bankruptcies or liens. Regularly reviewing this information helps you understand how your financial actions affect your creditworthiness.

Embracing Financial Awareness

At its core, understanding your financial standing involves embracing financial awareness. It’s about having a comprehensive grasp of your financial situation, including your assets—such as savings, investments, and property—and your liabilities—like debts, loans, and financial obligations. This awareness enables you to assess your net worth, a fundamental metric that gauges your financial health.

Taking Corrective Actions

Spotting errors or negative information on your credit report enables you to take corrective measures promptly. If you identify discrepancies, you can dispute them with the credit bureau responsible for reporting the information. By doing so, you ensure that your credit report accurately reflects your financial behavior.

Create a Concrete Plan

Developing a clear and actionable plan is key to addressing financial setbacks. Outline specific steps to rectify the problem, set achievable goals, and establish a timeline for implementing these changes. For instance, if it’s debt, create a repayment plan; if it’s overspending, draft a budget that aligns with your financial goals.

Communicate and Negotiate

Communication is crucial, especially when dealing with creditors or financial institutions. If you’re facing difficulties meeting payment obligations or want to negotiate better terms, reach out to them. Many creditors are willing to work with you to find viable solutions, such as revised payment schedules or interest rate reductions.

Prioritize and Adjust

Prioritize your financial goals based on urgency and importance. This might mean focusing on clearing high-interest debts first or curbing unnecessary expenses to allocate more funds towards savings or investments. Additionally, be prepared to adjust your lifestyle if necessary to align with your financial objective

Patience and Persistence Pay Off

Building credit is a gradual process that requires patience and persistence. As you consistently demonstrate responsible credit behavior, your credit score will gradually improve. Time plays a crucial role in establishing a robust credit history, so be patient and stay committed to sound financial practices.

In conclusion, building credit from scratch demands diligence and a strategic approach. By starting with secured credit cards or starter loans, making timely payments, and monitoring your credit report regularly, you lay the groundwork for a strong credit foundation that opens doors to various financial opportunities.