The right way to Handle Debt from A number of Credit score Playing cards Successfully With out Stress

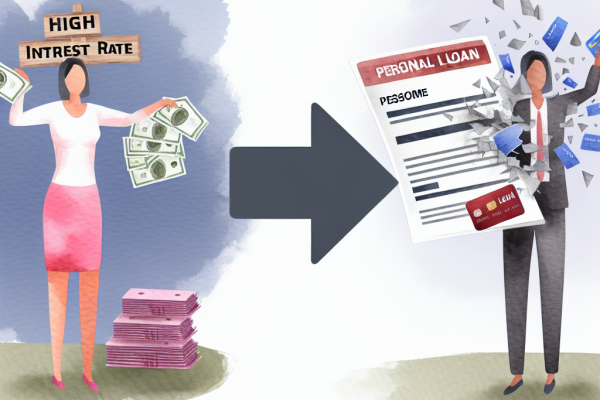

Managing debt from a number of bank cards successfully and with out stress is a problem confronted by many people at this time. With the simple accessibility of credit score, it is not unusual for folks to build up balances on a number of bank cards, every with completely different rates of interest and minimal…